from the 2010 earth services tax returns

Signed by a tax preparer at Yeo and Yeo, PC on November 15, 2011, Earth Inc's 2010 IRS tax return raises more questions for Mike Terpening. Terpening also signed the form November 15, 2011

2011 is the first full year Earth, Inc operated a licensed private child welfare institution. The organization took in some $396,329 it lists as solely contributions and grants and zero dollars as program service revenue.

Question 1

The tax return for 2010 calls for the signature of an officer, and the tax return is signed by Michael Terpening as the executive director.Part 7, page 7, section A requires the tax return to, "List all of the organizations current officers, directors, trustees (whether individuals or organizations), regardless of amount of compensation, and current key employees.

If this tax return was prepared by a Certified Public Accountant, how does the tax return require the signature of an officer of the corporate entity, that being Michael Terpening, not further list Mr. Terpening as a current officer of the corporate entity?

Question

2

Question

2

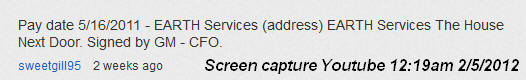

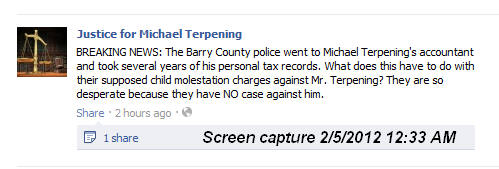

The felonious granny, Susan Ward Gillihan, was kind enough to provide the graphic to the right she purported to come from a check stub for payment to Jamie Moore Bell from Earth Services signed by the Chief Financial Officer of Earth, Inc, Gloria Mansfield. Jamie Moore Bell has also claimed to have worked as many as 90 hours weekly at the Earth Services child welfare agency.

How is it the tax return states Jamie Moore Bell received no payments from Earth, Inc? Jamie Moore Bell, in a video produced by Terpening Followers claims to have worked as much as 90 hours each week?

Question

3

Question

3

Earth Services reports no payments to employees, at all on its 2010 federal tax return. The 2010 tax return also shows a number of non-executive people known to have been working with the kids at Earth Services, the House Next Door during 2010.

Was Earth Services paying its people as sub-contractors to avoid its requirement to pay unemployment taxes, secure worker's compensation insurance and employer's match Social Security and Medicare taxes?

Question 4

Earth, Inc is a domestic non-profit corporation according to the Michigan Department of Licensing and Regulatory Affairs. This same entity has the authority to act using the legal assumed names, "Earth Services" and , "Earth Services the House Next Door." Earth, Inc is one corporate entity.

The internal revenue issues tax payer identification numbers, known as Employer Identification Numbers (EIN), similar to a social security numbers for for corporate and other entities. There are set rules for when the EIN changes.

For the tax year 2008, the Earth Inc tax return under the name Earth, Inc shows the EIN as 20-5927760. The tax return for 2009 under the name Earth Services The House Next Door Youth Program claiming to be both the initial and termination return shows an EIN as 27-1322630. The 2010 tax return states the EIN is 20-5927760.

Given all 3 returns are the same registered corporate entity, why do they have two EIN's?

Question 5

Presuming, contrary to evidence, there are two separate entities involved (see question above), how is it Earth Inc, with EIN 20-5927760, shows the very same income for the previous tax year 2009 found on the tax return or Earth Services the House Next Door, with an EIN 27-1322630? The 2010 tax return requires showing the income from the previous year.

Question 6

Given the apparent amateurish mistakes on this tax return, given it was filed months after the State of Michigan shut down Earth Services, The House Next Door, did the Certified Public Accounting agency really do this tax return? Or months following your arrest did you fudge the tax return, Mike?

- Form 990 Earth, Inc 2008 IRS Tax Return

- Form 990 Earth Services- The House Next Door Youth Program 2009 IRS TAX Return

- Form 990 Earth, Inc 2010 Tax Return

- Link for state corporate document filings

2009 and 2010 Tax Returns, Questions we've already asked